Compounding Part 1 - Making it the Default Calculation in a Linear World

- RIG

- Jul 18, 2024

- 3 min read

“. . . ’tis the stone that will turn all your lead into gold... Remember that money is of a prolific generating nature. Money can beget money, and its offspring can beget more."

- Ben Franklin

Key Takeaways:

Compounding is arguably the most important concept in investing.

Compounding is conceptually simple but often thought of as a “complex calculation”

Understanding and implementing compound calculations are two different modalities, with implementation being more difficult

“Insight, In Mind” is a useful method - detailed below.

To help understand compounding’s powerful effects, stories and tools are shared such as The Game of Rice; pithy quotes from Einstein about compound interest being the 8th wonder of the world, and of course the standard compound interest table (a financial advisor favorite).

Such rhetorical devices are helpful to fire up the mind, but the lesson can be fleeting. Not for lack of want, but for lack of use. Most folks consider linear calculations the default state - simple math at the grocery store or a restaurant, or when calculating travel time. Percentages are another default computation, and for the most part they are a linear extension. Meaning, 20% of a $100 restaurant bill is $20. The next step is the summation. From there, our math work is done, and we merrily go about our day (depending on the quality of the meal).

There are few daily circumstances that require thinking in terms of compounding.

For investing, however, thinking in exponentials is all that matters. The math required to calculate a one-year gain is linear – a $100 investment earns 7% therefore, I have $107. However, the math used to understand how long it takes to double your money from an investment earning 7% annually is more complicated. The Rule of 72 is a quick shortcut -- simply divide 72 by the annual rate of return. In our example, 72 / 7 = ~7.2 years, so our money doubles in about 7.2 years.

Making Compounding the Default Calculation:

As investors, our concern is how to make exponential math a default mental model as opposed to a tool-based approach (e.g., using Excel)?

Compounding calculations should be ensconced as the base case, and we must revert to linear calculations.

Charlie Munger provides a great answer we call “Insight, In Mind”

As described in a January 1996 article from Forbes featuring Munger on the cover:

Buffett and Munger share a deep respect for the awesome, mysterious power of compound interest. Charlie Munger loves to quote his hero, Benjamin Franklin, on the subject ... (recall the quote above).

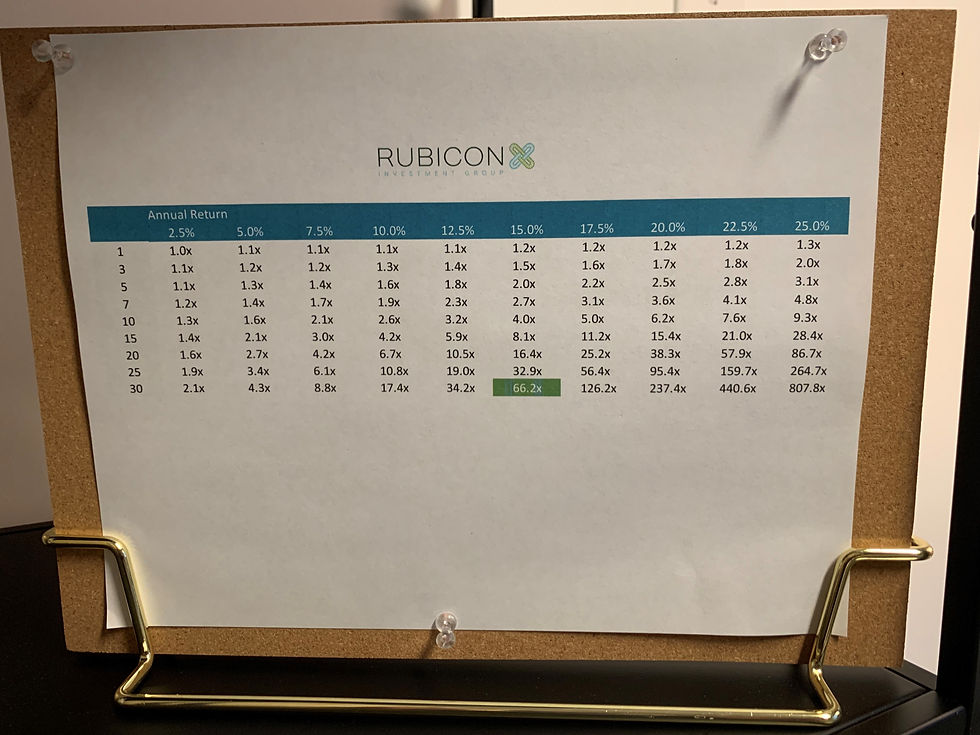

Munger is rarely without a compound rate of return table. He illustrates its magic by taking an investment of $1 and demonstrating that a return of 13.4% a year, after taxes, over 30 years, will make that $1 worth $43.50. To Munger it's much better to depend on compounding than on market timing.

“Understanding both the power of compound return and the difficulty getting it is the heart and soul of understanding a lot of things,” says Munger in typically grandiose terms.

1% IRR Implementation:

Always have a compound interest table (aka “Munger Table”) readily visible.

I keep mine on my desk. Looking at the table is a forcing function for long-term thinking. The dollar value of compounded money is so great that it becomes a habit to obsess over the long-term outcomes of decisions; a byproduct is eschewing the search for short-term gains.

Pro Tip: I highlight the 30-year, 15% Annual Return (why aim low?). Without looking, can you guess the compounded return? See the green highlight below for the answer.

Desktop Compound Table

Comments